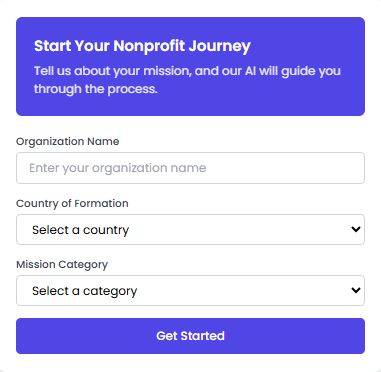

Set Up Your Nonprofit Corporation with AI-Powered Guidance

Join the future of business formation with our AI-driven platform. Streamline your Nonprofit Corporation establishment in Vietnam and business hubs worldwide with expert guidance and cutting-edge AI technology.

Our AI-Powered Nonprofit Formation Services

Our platform leverages artificial intelligence to simplify and accelerate the nonprofit incorporation process.

Legal Compliance

Our AI analyzes and ensures compliance with local nonprofit regulations in each jurisdiction, minimizing legal risks.

Document Preparation

Our platform automatically generates all required legal documents tailored to your nonprofit’s mission and location.

Expedited Filing

Our streamlined process ensures the fastest possible approval times for your nonprofit corporation formation.

Board Development

Guidance on establishing an effective board structure that meets legal requirements and organizational needs.

Tax Exemption

Expert assistance with securing tax-exempt status in your jurisdiction, maximizing financial benefits.

Ongoing Support

Continuous assistance with compliance, reporting, and operational requirements after formation.

AI-Powered Nonprofit Formation

Our advanced AI platform streamlines the nonprofit incorporation process across multiple jurisdictions, ensuring compliance with local regulations.

Smart Document Generation

Our AI creates jurisdiction-specific documents tailored to your organization’s mission and needs.

Compliance Monitoring

Continuous monitoring of regulatory changes to keep your nonprofit in compliance.

Multilingual Support

Navigate international requirements with AI-powered translation and localization.

Our End-to-End Formation Process

We handle every aspect of establishing your nonprofit corporation, from initial consultation to final approval.

Initial Consultation

Our AI system analyzes your mission, goals, and operational needs to determine the optimal nonprofit structure.

Document Preparation

Our platform automatically generates all required legal documents tailored to your specific needs and jurisdiction.

Filing & Registration

We handle all government filings and registrations required to establish your nonprofit corporation.

Tax Exemption

We prepare and submit applications for tax-exempt status in your jurisdiction.

Compliance Setup

e establish systems to ensure ongoing compliance with all regulatory requirements.

Benefits of Forming a Nonprofit Corporation

Establishing your organization as a nonprofit corporation provides numerous advantages that help you maximize your social impact.

Tax-Exempt Status

Nonprofits are exempt from federal income taxes, allowing more resources to be directed toward your mission. Additionally, donors may receive tax deductions for their contributions.

Grant Eligibility

Access to grants and funding opportunities worldwide.

Nonprofit status opens doors to grants from government agencies, foundations, and corporations that are only available to registered nonprofit organizations.

Limited Liability

Protection of personal assets from organizational debts and legal claims against the nonprofit.

Directors, officers, and members are generally protected from personal liability for the organization’s debts and legal obligations.

Postal Rate Discounts

Eligible nonprofits can receive special bulk mailing rates and other postal discounts, reducing operational costs.

Discounted Services

Access to reduced rates on postage, advertising, software, and other business services.

Credibility

Official nonprofit status enhances your organization’s credibility with donors, volunteers, and the communities you serve.

Perpetual Existence

Nonprofits can continue to exist beyond the involvement of the original founders, ensuring your mission continues for generations.

Global Operations

Legal framework to operate internationally and receive cross-border funding and support.

Required Documents

Essential paperwork needed to establish your nonprofit corporation.

Document Checklist

Our AI platform will help you prepare and file all necessary documents based on your specific jurisdiction requirements.

Articles of Incorporation

The primary document filed with the government agency that officially creates your nonprofit corporation.

Tax Exemption Application

Documentation required to obtain tax-exempt status from tax authorities.

Bylaws

Internal governing document that outlines how your nonprofit will operate.

Conflict of Interest Policy

Policy that helps ensure board members act in the organization’s best interest.

IRS Form 1023

Application for tax-exempt status under section 501(c)(3) of the Internal Revenue Code.

EIN Application

Application for an Employer Identification Number, required for tax filings and bank accounts

State Tax Exemption Application

Forms required to obtain state-level tax exemptions, which vary by jurisdiction.

Annual Reporting Forms

Templates for ongoing compliance reporting required to maintain nonprofit status.

Global Nonprofit Formation

Our AI-powered platform supports nonprofit formation across multiple countries and jurisdictions.

United States

Complete 501(c)(3) formation services with state-specific compliance.

Federal and state filings

IRS tax exemption

State-specific requirements

Canada

Federal and provincial nonprofit corporation formation with charity status.

Federal incorporation

CRA charity registration

Provincial registrations

United Kingdom

Charity and CIC formation with Charity Commission and Companies House.

Charity registration

CIC formation

HMRC tax exemption

Australia

Nonprofit company and charity registration with ACNC compliance.

ACNC registration

DGR status application

State registrations

European Union

Formation services across EU member states with cross-border compliance.

Country-specific formation

EU-wide compliance

Multi-language support

Global Expansion

Support for international nonprofits expanding operations to new countries.

Multi-country registration

Cross-border compliance

International fundraising

Don’t see your country? Our AI platform supports nonprofit formation in over 50 countries worldwide.

Formation Packages for Your Nonprofit Corporation

Our AI-integrated platform provides end-to-end solutions to establish your nonprofit organization worldwide with tax-exempt status and legal protection.

Basic

$299 one-time

Essential formation services for small nonprofits with straightforward needs.

Professional

$599 one-time

Comprehensive formation with additional compliance and tax-exempt support.

Premium

$999 one-time

Complete end-to-end solution with global support and advanced AI tools.

Detailed Package Comparison

Compare our packages to find the right fit for your nonprofit’s needs

| Features | Basic $299 | Professional $599 | Premium $999 |

| Formation Essentials | |||

| Name Availability Check We verify your nonprofit name is available in your jurisdiction. | ✓ | ✓ | ✓ |

| Articles of Incorporation AI-generated formation documents filed with your appropriate government agency. | ✓ | ✓ | ✓ |

| EIN Application Employer Identification Number application with the IRS | ✓ | ✓ | ✓ |

| Bylaws | Standard Template | Customized | Customized + AI Optimized |

| Tax Exemption | |||

| 501(c)(3) Application | x | ✓ | ✓ |

| International Tax Exemption Support | x | x | ✓ |

| Compliance & Governance | |||

| Board Meeting Minutes Templates | x | ✓ | ✓ |

| Conflict of Interest Policy | x | ✓ | ✓ |

| Compliance Monitoring | x | 1 Year | 3 Year |

| Registered Agent Service | x | 1 Year | 3 Year |

| AI-Powered Tools | |||

| Digital Document Storage | ✓ | ✓ | ✓ |

| AI Grant Matching Tool | x | x | ✓ |

| Donor Management System | x | x | ✓ |

| Support | |||

| Customer Support | Email & Chat | Priority Email, Chat & Phone | |

| Dedicated Formation Specialist | x | x | ✓ |

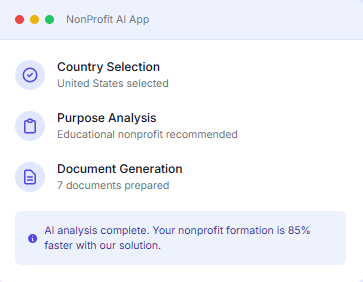

Our AI-Integrated Platform

Our innovative platform leverages artificial intelligence to streamline the nonprofit formation process, ensuring accuracy and compliance while saving you time and resources.

Frequently Asked Questions

Everything you need to know about our nonprofit formation services

A nonprofit corporation is a legal entity organized for purposes other than generating profit. These organizations can receive tax-exempt status, allowing them to operate without paying federal income taxes and enabling donors to make tax-deductible contributions.

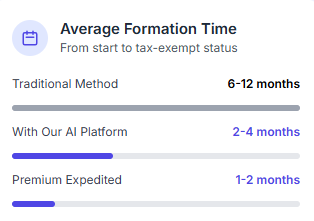

With our AI-integrated platform, the basic formation process typically takes 2-4 weeks. Obtaining 501(c)(3) tax-exempt status can take an additional 1-3 months with our Professional package, or as little as 3-6 weeks with our Premium expedited service.

Our AI system analyzes your nonprofit’s mission, activities, and goals to generate optimized formation documents that comply with relevant laws. It streamlines the application process, provides compliance monitoring, and offers intelligent recommendations for governance and fundraising.

Our platform supports nonprofit formation in the United States, Vietnam, Canada, United Kingdom, Australia, and select European countries. Each package is tailored to meet the specific legal requirements of the jurisdiction where you’re establishing your nonprofit.

Nonprofits must file annual reports, maintain proper records, and submit tax returns. Our Professional and Premium packages include compliance monitoring tools that automatically track deadlines and send reminders for required filings.

Yes, you can upgrade to a higher-tier package at any time. We’ll apply the full amount you’ve already paid toward the cost of the upgraded package, making the transition seamless and cost-effective.

Our AI system continuously monitors legal requirements across jurisdictions and is updated in real-time. All documents undergo both AI compliance checks and human expert review before submission to ensure accuracy and adherence to current regulations.

Yes, we offer a satisfaction guarantee. If your nonprofit application is rejected due to errors in our documentation, we’ll either fix the issues at no additional cost or provide a full refund of our service fees (excluding government filing fees).

Ready to Form Your Nonprofit?

Get started today with our AI-powered platform and focus on your mission while we handle the paperwork.