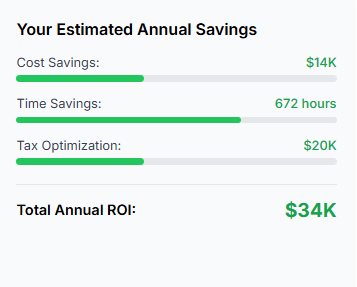

Corporate Income Tax

Strategic tax planning and preparation services to minimize liabilities and ensure compliance with changing regulations

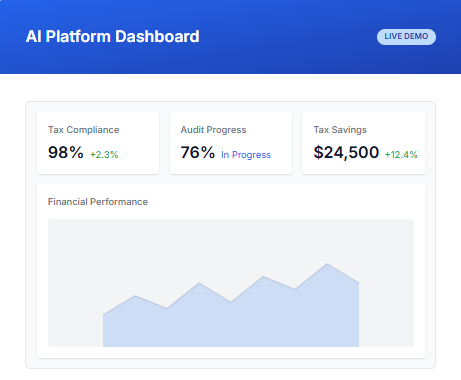

Tax Compliance Management

Automated monitoring and management of tax deadlines, filings, and regulatory requirements across jurisdictions

Financial Statement Preparation

Accurate and timely preparation of balance sheets, income statements, and cash flow statements with AI-assisted analysis.

Corporate Audit Reporting

Comprehensive audit services with AI-driven risk assessment and anomaly detection for enhanced accuracy.

Bookkeeping

Automated transaction categorization and reconciliation with real-time financial data processing and error detection.

Financial Reporting

Customizable reporting solutions with interactive dashboards and predictive analytics for informed decision-making.

Detailed Feature Comparison

| Features | Starter | Professional | Enterprise |

| Tax Services | |||

| Corporate Income Tax Preparation and Filing of corporate income tax returns. | Basic | Advanced | Comprehensive |

| Tax Compliance Management Ensuring adherence to tax regulations and deadlines. | ✓ | ✓ | ✓ |

| Tax Planning & Strategy Proactive tax optimization strategies. | — | Basic | Advanced |

| International Tax Support Managing tax obligations across multiple jurisdictions. | — | — | ✓ |

| Accounting Services | |||

| Bookkeeping Recording financial transactions and maintaining ledgers. | Basic | Advanced | Comprehensive |

| Financial Statement Preparation Creation of income statements, balance sheets, and cash flow statements. | Quarterly | Monthly | Custom Schedule |

| Financial Reporting Detailed financial analysis and reporting. | Basic | Advanced | Custom |

| Audit Services | |||

| Corporate Audit Reporting Comprehensive audit of financial statements and controls. | — | ✓ | ✓ |

| Internal Control Assessment Evaluation of internal financial controls & process. | — | Basic | Advanced |

| Compliance Audits Specialized audits for regulatory compliance. | — | — | ✓ |

| AI-Powered Features | |||

| AI-Powered Financial Analysis Advanced analytics using machine learning algorithms. | — | Basic | Advanced |

| Predictive Financial Modeling AI-driven forecasting and scenario planning. | — | ✓ | ✓ |

| Automated Document Processing AI-powered extraction and processing of financial documents. | Basic | Advanced | Advanced |

| Anomaly Detection AI-based identification of unsual financial patterns. | — | Basic | Advanced |

| Support & Services | |||

| Customer Support Access to support team for assistance. | Email & Phone | 24/7 Priority | |

| Dedicated Account Manager Personal point of contact for your account. | — | — | ✓ |

| Training & Onboarding Platform training and implementation assistance. | Self-service | 2 Sessions | Custom |