Set Up Your S-Corporation Globally with AI-Powered Guidance

Streamline your S-Corp formation process with expert guidance and AI tools designed for success in business hubs worldwide.

Comprehensive S-Corp Formation Services

Everything you need to establish and maintain your S-Corporation.

Business Name Verification

AI-powered real-time name availability checking across multiple jurisdictions and trademark databases.

• Instant availability results.

• Trademark conflict detection.

• Alternative name suggestions.

• Domain availability check.

Document Preparation

Automated generation of all required legal documents with AI-assisted customization for your specific needs.

• Articles of Incorporation;

• Corporate Bylaws;

• Stock Certificates.

• Meeting Minutes Templates.

Filing Coordination

Seamless submission to government agencies with real-time tracking and status updates.

• Automated filing submission.

• Real-time status tracking.

• Error detection & correction.

• Expedited processing options.

Digital Dashboard

Comprehensive management portal with AI insights for ongoing corporate governance and compliance.

• Real-time compliance status.

• Document storage & access.

• Financial reporting tools.

• Performance analytics.

Compliance Reminders

AI-powered monitoring system that tracks deadlines and regulatory requirements automatically.

• Automated deadline tracking.

• Multi-channel notifications.

• Regulatory change alerts.

• Penalty avoidance system.

Expert Consultation

Access to legal and business experts enhanced by AI-driven insights for personalized guidance.

• 24/7 AI-assisted support’

• Expert legal consultation.

• Business strategy guidance;

• Compliance advisory services.

Why Choose Our AI-Integrated Platform

Our platform combines expert guidance with cutting-edge AI to streamline your S-Corporation setup process in business hubs worldwide.

Global S-Corp Formation

Set up your S-Corporation in any country with our comprehensive guidance tailored to local regulations and requirements.

AI-Powered Document Preparation

Our AI system helps you prepare all necessary documents with precision, ensuring compliance with local regulations.

Enhanced Corporate Governance

Implement effective corporate governance structures with our expert guidance and customizable templates.

Expert Consultation

Access our network of S-Corporation specialists who provide personalized guidance throughout the formation process.

Compliance Monitoring

Our AI continuously monitors regulatory changes to ensure your S-Corporation remains compliant with evolving requirements.

Time-Saving Automation

Complete your S-Corporation formation in record time with our efficient, step-by-step guided process and automation tools.

Customized Solutions

Receive personalized recommendations based on your industry, size, and specific business goals.

24/7 Support

Get answers to your questions anytime with our AI assistant, backed by human experts when needed.

How Our Platform Works

A simple, streamlined process to set up your S-Corporation with AI assistance.

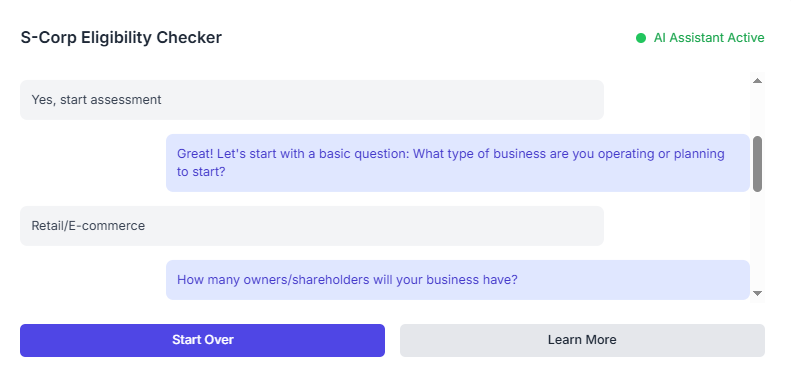

Step 1: Assessment

Our AI analyzes your business needs and goals to determine if an S-Corporation is the right structure for you.

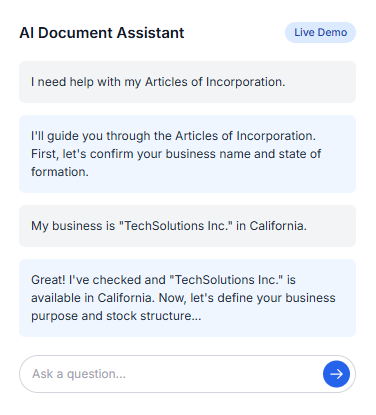

Step 2: Document Preparation

Our AI helps you prepare all necessary formation documents, tailored to your specific jurisdiction’s requirements.

Step 3: Expert Review

Our S-Corporation specialists review your documents to ensure accuracy and compliance with all regulations.

Step 4: Filing and Registration

We guide you through the filing process with the appropriate government agencies to officially establish your S-Corporation.

Step 5: Ongoing Support

Our AI platform continues to provide guidance and tools for maintaining compliance and effective corporate governance.

S-Corporation Benefits

Maximize your business advantages with an S-Corporation structure.

Pass-Through Taxation

Avoid double taxation as business profits and losses pass directly to shareholders’ personal tax returns.

Self-Employment Tax Savings

Reduce self-employment taxes by allowing shareholders to receive both salary and distributions.

Limited Liability Protection

Shield personal assets from business debts and liabilities while maintaining corporate structure benefits.

Enhanced Credibility

Gain increased business credibility with customers, vendors, and partners through formal corporate structure.

Perpetual Existence

Your business continues regardless of ownership changes, providing stability and continuity.

Ownership Flexibility

Easily transfer ownership through the sale of stock shares while maintaining business operations.

Essential S-Corporation Documents

Our platform guides you through preparing and filing all necessary documents for your S-Corporation.

Articles of Incorporation

The foundational document that establishes your corporation with the state. Our AI helps you prepare this document with all required information.

Form 2553 (S-Corp Election)

The IRS form required to elect S-Corporation status. Our platform ensures accurate completion and timely filing.

Corporate Bylaws

Internal rules governing your corporation’s operations. Our AI helps create customized bylaws for your specific needs.

Shareholder Agreement

Defines the relationship between shareholders. Our platform helps create comprehensive agreements tailored to your business.

Meeting Minutes Templates

Essential for documenting corporate decisions. Our AI provides customizable templates for board and shareholder meetings.

Compliance Calendar

Stay on top of all filing deadlines and compliance requirements with our AI-powered compliance calendar.

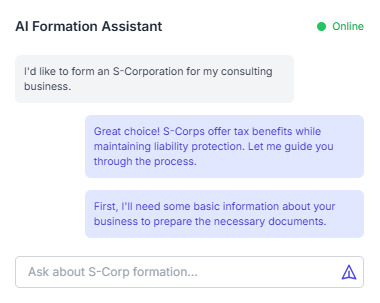

AI-Powered Business Formation

Our advanced AI technology transforms the complex process of forming an S-Corporation into a streamlined, user-friendly experience.

Intelligent Document Analysis

Our AI reviews all your documents for errors, inconsistencies, and compliance issues before submission.

Personalized Recommendations

Receive tailored guidance based on your industry, business size, and specific goals.

Compliance Monitoring

Our AI continuously tracks regulatory changes and alerts you to any actions needed to maintain compliance.

Choose Your S-Corp Formation Plan

Our AI-integrated platform provides expert guidance and tools to set up your S-Corporation worldwide with ease and efficiency.

Starter

Essential tools for new S-Corps.

$29/month

$23/month (Annually Save 20%)

Professional

Complete solution for growing businesses.

$79/month

$63/month (Annually Save 20%)

Enterprise

Full-service global S-Corp management.

$199/month

$159/month (Annually Save 20%)

Detailed Feature Comparison

| Features | Starter | Professional | Enterprise |

| Business Name Verification | Yes | Yes | Yes |

| Document Preparation | Basic | Advanced | Premium |

| Filing Coordination | Yes | Yes | Yes |

| Digital Dashboard | Basic | Advanced | Enterprise |

| AI Compliance Monitoring | x | Yes | Yes |

| Expert Consultations | x | 2 per month | Unlimited |

| Tax Filing Reminders | x | Yes | Yes |

| Corporate Governance Tools | x | Yes | Yes |

| International Expansion Support | x | x | Yes |

| Dedicated Account Manager | x | x | Yes |

Frequently Asked Questions

An S-Corporation is a special type of corporation that passes corporate income, losses, deductions, and credits through to shareholders for federal tax purposes. This allows S-Corporations to avoid double taxation on corporate income while still providing the liability protection of a corporation.

Our AI-integrated platform streamlines the S-Corp formation process by automating document preparation, verifying business name availability, and ensuring compliance with local regulations. The AI continuously monitors regulatory changes and provides personalized recommendations for your business structure based on your specific needs and goals.

While S-Corporations are a U.S. business structure, our platform supports equivalent pass-through entity formation in over 30 countries worldwide. Our Enterprise plan includes specialized international expansion support to navigate the specific requirements of each jurisdiction.

Yes, you can upgrade or downgrade your plan at any time. When upgrading, you’ll gain immediate access to additional features. If you downgrade, you’ll maintain access to your current features until the end of your billing cycle.

Ready to Start Your S-Corporation Journey?

Join thousands of businesses using our AI-integrated platform to streamline their S-Corp formation and management.